Haven’s Leverage System

Haven’s leverage system uses what is known as “threshold-based constant leverage” or otherwise known as “bracketed leverage”. With Haven’s bracketed leverage, you can achieve gains significantly higher than traditional leverage while eliminating the risk of liquidation.

How it works

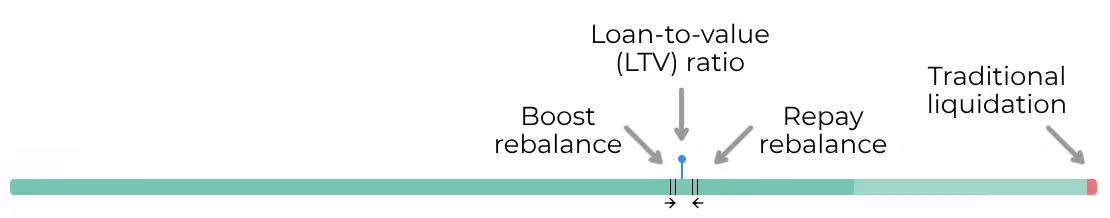

Leverage involves two central values: collateral and debt. From these, a loan-to-value ratio (LTV) can be calculated, representing the ratio between your total debt and total collateral. A higher LTV indicates higher leverage and vice versa. In traditional leverage, if your LTV reaches 100%, your position is liquidated.

Haven’s bracketed leverage system maintains specific LTV values using user-customized settings. This approach enables Haven to perform “boost” and “repay” rebalances:

- Boost rebalance: When your position’s LTV drops below the minimum LTV, Haven automation will increase the LTV by borrowing additional debt and adding it to the collateral.

- Repay rebalance: When your position’s LTV exceeds the maximum LTV, Haven automation will lower the LTV by repaying a portion of the debt using collateral.

By maintaining a controlled range, Haven prevents positions from reaching liquidation (an LTV of 100%). Additionally, this mechanism amplifies leverage gains, as it increases LTV over time when the target asset moves in the anticipated direction.

The power of compounding

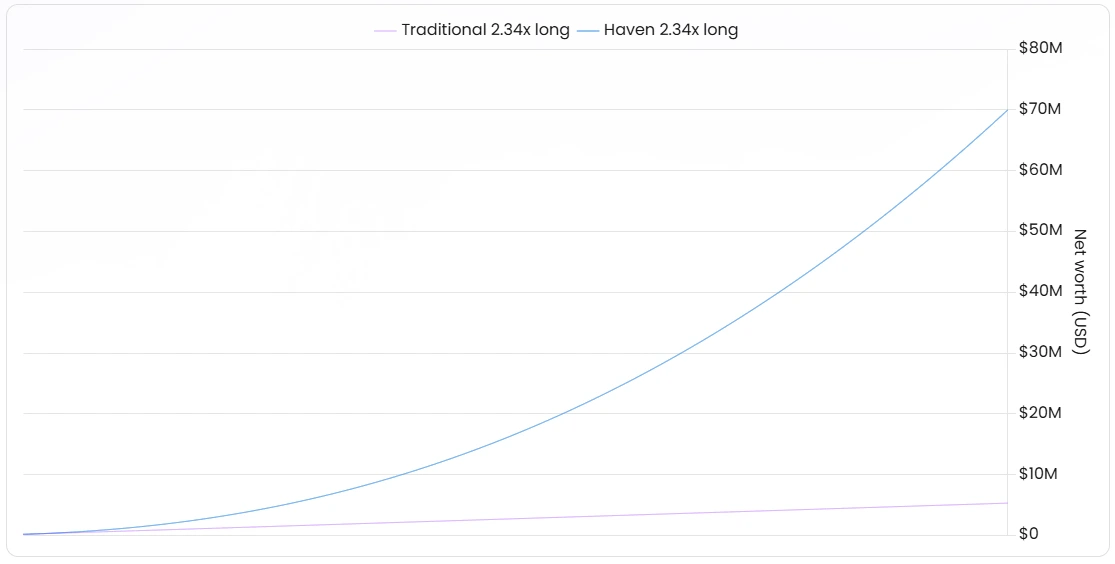

With Haven’s bracketed leverage, “boost” rebalances over time can have a compounding effect when positions are effectively aligned with significant asset price movements.

Below is an illustrative example of a Haven Long position on an asset that steadily increases in value at a fixed rate. As shown, the Haven position benefits from a clear exponential compounding effect, as each boost rebalance increases the collateral, which in turn enables larger subsequent boosts, further increasing the collateral over time.

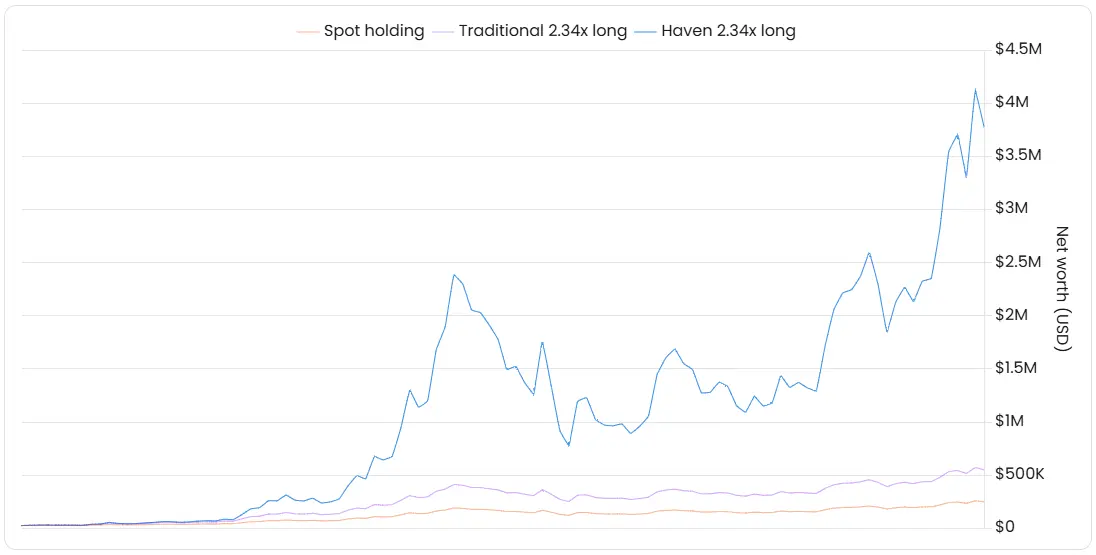

Of course, this example is exaggerated, as markets don’t behave in such a fixed manner in real life. However, we can explore a more realistic scenario by looking at the historical price action of SOL from July 7th, 2021, to November 20th, 2021. The example below compares the performance of a Haven Long position on SOL to a traditional leverage position and a simple spot hold. Due to the compounding effect, Haven’s gains are exponentially higher than those from spot and traditional leverage.

Risks

In finance, there’s no such thing as a free lunch—profits are rarely generated without corresponding risks. Typically, gains are proportional to the risk taken, and Haven is no exception. While Haven’s bracketed leverage can eliminate liquidation risk and increase leverage profits, it introduces a unique risk: volatility decay.

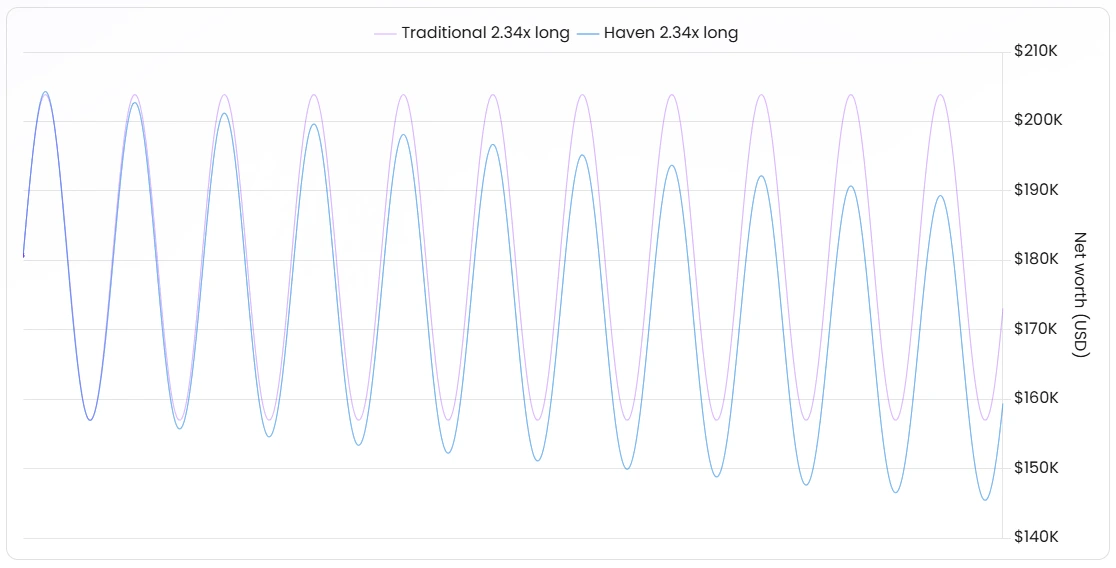

When holding a leveraged position and the market moves in an unexpected direction, losses with Haven may exceed those from traditional leverage (excluding liquidation scenarios). This is because Haven maintains a specific LTV by repaying debt with collateral. Furthermore, if the market eventually returns to its starting point, a Haven position will generally be slightly smaller than one with traditional leverage, a result of volatility decay.

To illustrate volatility decay, the example below compares positions for Haven and traditional leverage in an exaggerated scenario where the collateral asset price oscillates up and down in an extreme manner, triggering Haven’s rebalancing to maintain LTV.

Volatility decay explains why higher leverage doesn’t always translate to higher returns with Haven’s leverage system. Higher leverage increases the frequency of boosts and repays, which amplifies the effects of volatility decay compared to lower leverage.

Minimizing the risks

With a clear understanding of the risks associated with Haven’s bracketed leverage, users can make more informed decisions to help mitigate these risks. This involves two primary strategies:

Make the correct “long” or “short” choice based on market conditions & timing:

In practical terms, this means: avoid shorting in a general market uptrend (bull market), avoid longing in a general market downtrend (bear market), and aim to preserve gains by minimizing unnecessary round-trips, as volatility decay can be very impactful during round-trips. Additionally, it’s important to keep in mind that Haven leverage is most effective for investments following significant market movement, rather than small price swings.

Optimize leverage settings for your specific asset and position size:

It’s also important to optimize leverage settings for maximum returns, as your ideal settings will depend on the asset you’re leveraging and the size of your position (in USD). Haven’s simulation feature can help you determine the ideal settings by generating random price action toward a specified target price. More info on our simulation feature here.

Reduce the number of positions and concentrate your liquidity:

Due to Haven compounding, the risk of volatility decay and Haven’s fee structure, it’s more advantageous to concentrate your liquidity into fewer positions. For example, a single 2x SOL position of $1,000 can be more profitable than holding two 2x SOL positions of $500 each. Even though the total investment and leverage factor remain the same, focusing your liquidity in one position can yield higher returns. This effect is a unique feature of Haven leverage compared to traditional leverage. Haven allows you to deposit additional liquidity into an existing position instead of opening a new one whenever you want to increase your exposure.

Further Reading

- Haven’s “moving liquidation price”

- On the topic of liquidation cascades / “scam wicks”

- Traditional leverage liquidation vs. Haven leverage

Questions & Support

For any questions or support, please join our Discord or Telegram and we will get back to you as soon as we can!